Earned Wage Access Sees Striking Growth in South Africa

Leading earned-wage access (EWA) platform, Paymenow has shown exponential growth over the past four years, driven by increased uptake of the service by corporates for their employees.

Earned Wage Access (EWA) allows workers to access their already-earned but unpaid wages before their regular payday. This is beneficial for employees needing real-time access to their earnings – an ever more common occurrence in an economic environment marked by persistent cost-of-living increases.

Paymenow, South Africa’s leading provider of EWA solutions for workers and businesses, has analysed the use of its platform since its launch in 2020. The analysis provides valuable insights into how EWA is being utilised in South Africa to meet critical needs and the rising demand for EWA in South Africa.

Denise Neethling, Head of Marketing at Paymenow, said “In the context of persistently high inflation, economic and political uncertainty, and rising interest rates, employees are under real pressure. EWA provides a lifeline that more and more employees are eager to take, and which is increasingly preventing indebtedness. As our 2023 Impact Performance Report showed, 92% of customers would have had to borrow money if they hadn’t had support from Paymenow, and 94% of Paymenow customers say their quality of life has improved, with two-thirds reporting significant improvements.”

The Paymenow user base is diverse and growing:

- 53% female

- Around one-third are millennials (born 1981–1996)

- Just under 10% are Gen Z (born after 1996)

- Roughly 10% are Gen X (born 1965–1980)

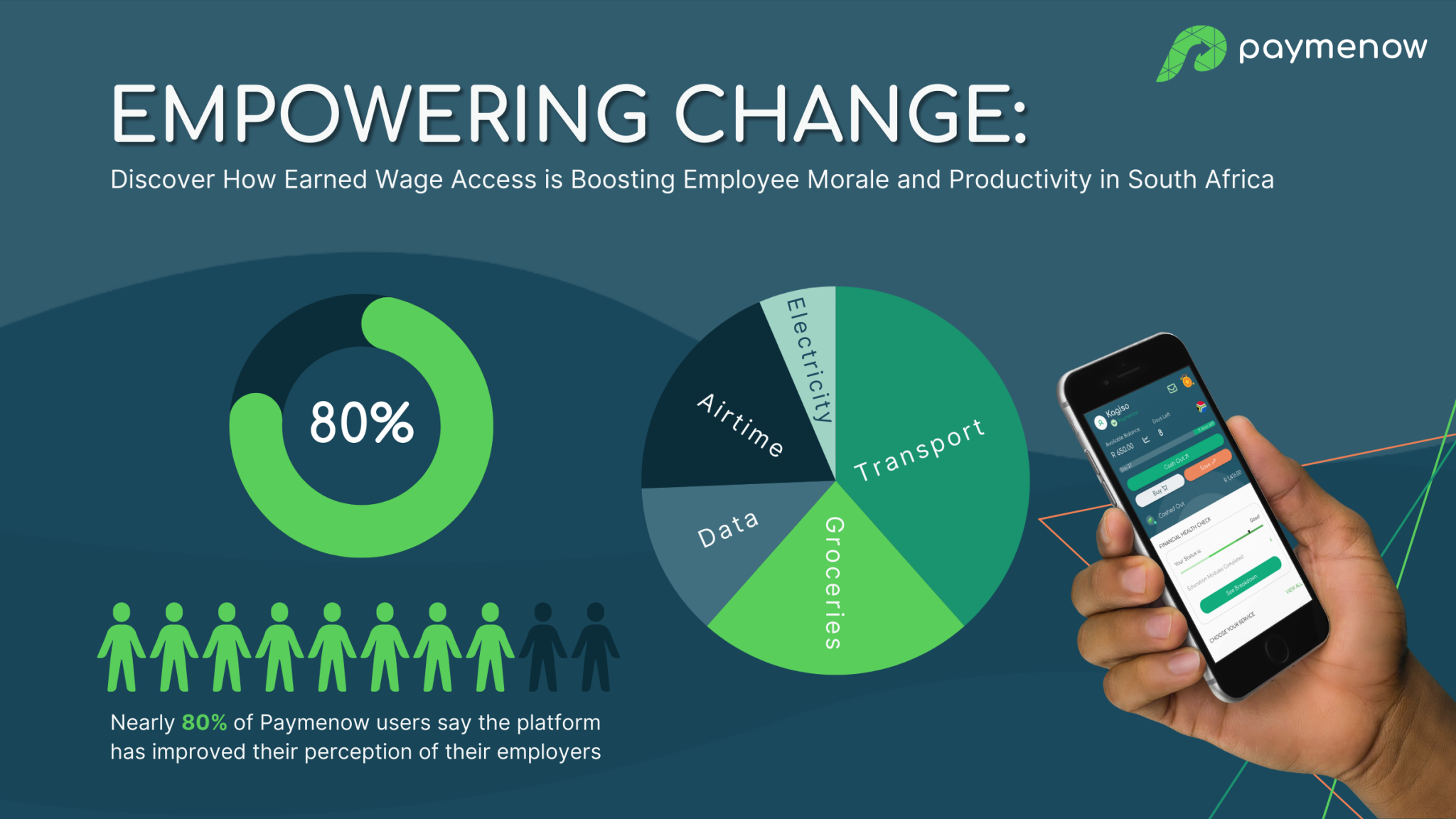

Paymenow users can access their earned wages via either cash-outs or voucher purchases, with data showing a 50-50 split. Cash-outs place the money in a user’s bank account to be used for discretionary spending, while voucher purchases are for necessity products. The data indicates money cashed out is largely spent on transport costs (approx. 30%), with food being the next-largest reason (approx. 18%). In terms of voucher purchases, an average of 43% of vouchers are for airtime, 30% for grocery vouchers and 18% for data. A smaller portion (8%) is used to buy electricity vouchers.

However, the most striking trend in the data is Paymenow’s explosive growth. When the company launched in 2020, only a few thousand transactions were processed monthly. Currently, Paymenow processes over half a million transactions per month. In light of the platform’s steady growth, volumes are predicted to increase to over a million by the end of 2024.

“This rapid growth is driven by increasing numbers of corporates realising the value of offering EWA as an employee benefit,” Neethling explained. “Not only does EWA empower users, but research from Harvard University and similar institutions shows that EWA increases employee well-being, productivity and loyalty. Nearly 80% of Paymenow users say the platform has improved their perception of their employers. These users talk about viewing their employer as more caring and considerate, and report better financial well-being and reduced stress. Especially in the current economic environment, companies looking to uplift their workforce while also increasing loyalty and productivity have a great solution in the form of EWA.”