Earned Wage Access Provides Financial Relief to Young People This Youth Month

Earned Wage Access (EWA), which allows employees to access their earned wages before their regular pay cycle, is experiencing massive global growth, with young people increasingly at the forefront of its adoption.

EWA is particularly beneficial for employees needing real-time access to their earned wages in an economic environment marked by persistent cost-of-living increases and below-inflation salary increases. People younger than 35 are turning to EWA to avoid indebtedness, pay for household necessities, and enhance their financial independence.

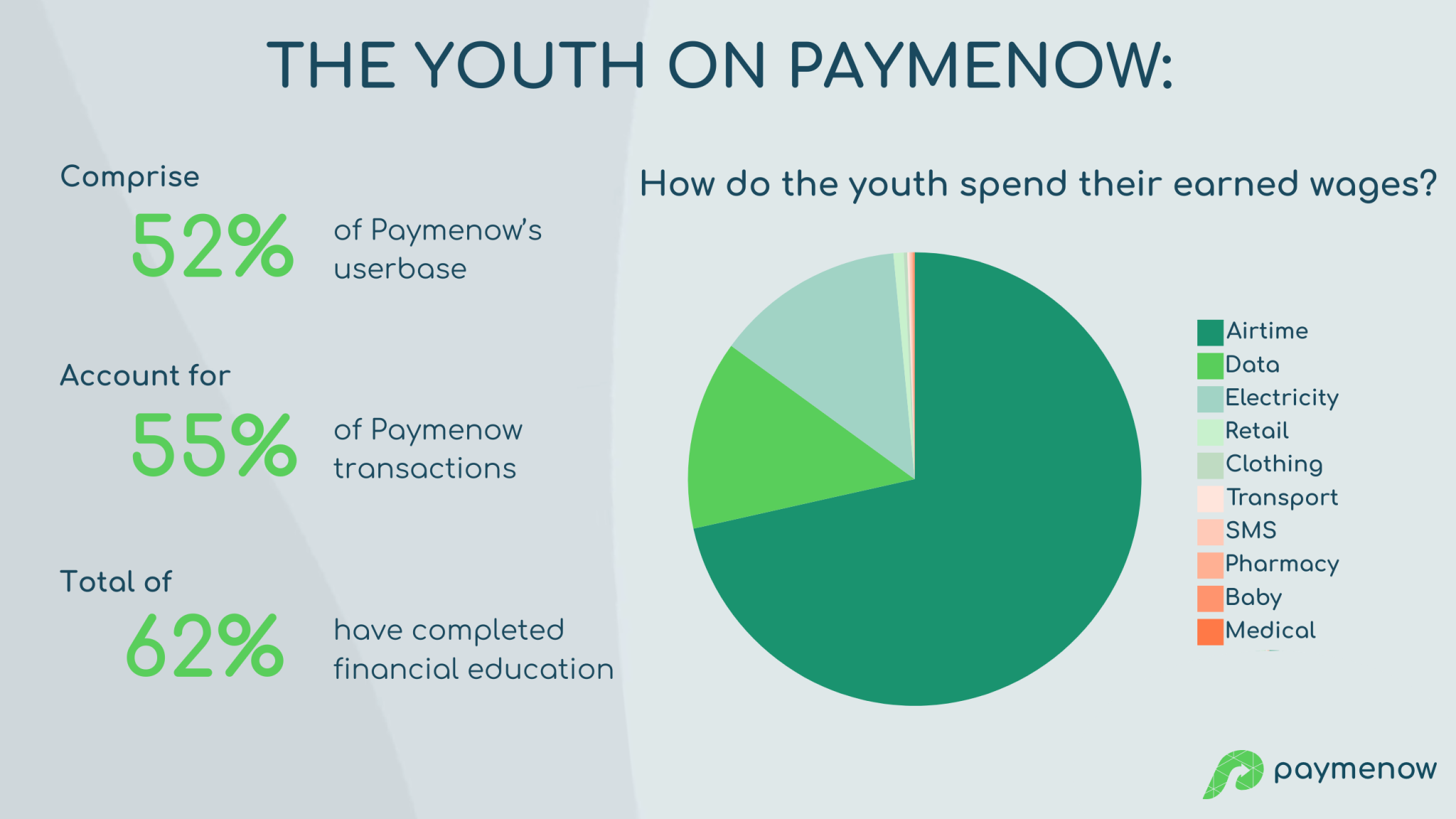

Analysis of the usage profile for Paymenow, South Africa’s leading EWA provider, shows that youth make up the majority – 52.2% – of users on the platform. They also account for 55% of all transactions logged on the platform.

Denise Neethling, Head of Marketing at Paymenow, stated, “Young people are typically more technologically adept, willing to adopt innovative platforms, and are often more cash-stretched than older users. In the context of persistently high inflation, economic uncertainty, and high interest rates, consumers are under pressure, and young people are often disproportionately affected.”

Youth on the Paymenow platform typically buy vouchers with their earned wages – transport (76%)*, airtime (64%)*, data (51%)*, clothing (51%)*, and electricity (50%)*. Additionally, 51% of the youth use cash-outs for discretionary spending. “With the rise of social media platforms, mobile money, and the need to stay connected, it is not surprising to see airtime and data as main reasons for voucher spending in the youth market in South Africa.”

Young people have also embraced Paymenow’s free in-app financial education training, with 62.3% of users under 35 accessing Paymenow’s Gold Tier compared to 59% of adult users.

Paymenow users who have completed the financial education and have reached Gold status can buy vouchers completely free of fees. Neethling explains, “Having access to this resource empowers users to make more informed decisions and build a strong financial foundation. As we have seen with the stats, our financial education is paying off with more users taking the time to upskill themselves to get to that Gold Tier status and ensuring that their earned wages stretch further.”

Neethling concluded, “The number of young people accessing EWA has grown consistently since Paymenow’s launch, and EWA is increasingly seen as a benefit that adds to a company’s employee value proposition. It’s not unexpected that this segment should be the first to adopt this innovative platform, which we firmly believe marks the future of wages.”

* The percentages stated represents the total % of Paymenow transactions within the said category and don’t represent total youth transactions (example 76% of transport vouchers are bought by youth).

However, as we embrace the benefits of fintech for mental wellbeing, it’s essential to also recognise the challenges it may pose. Ensuring that these solutions are inclusive and accessible to individuals regardless of socioeconomic status or financial literacy is crucial. Furthermore, safeguarding data privacy and security is paramount, as fintech solutions depend on sensitive personal financial information.

“Despite these challenges,” Neethling concludes, “the opportunities fintech presents for improving mental wellbeing are vast. By providing real-time support and interventions, fintech can potentially identify and address financial stressors before they escalate into significant mental health issues. Additionally, these solutions can foster a sense of community, connecting users with others facing similar challenges and enabling a shared journey toward financial and mental wellness.”