Earned Wage Access Increases Employee Wellbeing, Reduces Absenteeism

A set of reports independently prepared by impact-measurement specialists 60 Decibels, in December 2024, lays out a compelling set of benefits of Earned Wage Access (EWA) for both employees and employers.

The reports, based on a number of telephonic interviews with not only users but also with key stakeholders at employers, who had rolled out an EWA service from globally recognised EWA provider Paymenow, clearly show that EWA provides a responsible lifeline that more and more of the most financially excluded employees are able to access, and which is increasingly seen as a necessary component of an employee value proposition.

EWA is a financial service offering that allows employees to access a portion of their earned wages before their regular payday. Earned-wage access represents a significant advancement in employee financial wellness programmes, delivering measurable benefits for both workforce and workplace. Deon Nobrega, CEO at Paymenow says, “The data demonstrates that EWA serves as more than just a convenient payment option – it is a transformative tool that enhances employees’ financial stability, reduces workplace stress, and improves attendance rates.”

- The 60 Decibels Users Impact Performance Report found that EWA was positively impacting users’ lives and enhancing their overall financial wellbeing.

- 9 out of 10 users report an improved quality of life, with nearly half noting significant improvements. They highlighted a greater ability to afford transportation, greater levels of self-reliance, and reduced stress levels.

- 3 in 4 users reported an increase in savings, and nearly 7 in 10 reported lower debt levels since they started using EWA.

- 9 in 10 users would have had to borrow money if they did not have access to EWA.

- Majority of users reported that EWA had positively influenced their perception of their employers.

- Paymenow recorded an outstanding Net-Promoter Score (NPS) of 72.

- 8 out of 10 users consider Paymenow’s service to be “extremely important” and would want access to it even if they switched jobs.

One user, a male aged 35 years, said “Since I started using the service, I have managed to pay off most of my debts, start saving money again, and stay on track with my debit orders and policies. I am very happy and satisfied with the service.”

A 28-year-old male reported that “It has positively impacted my work relationship because I no longer need to skip work due to a lack of transport money. I am always at work and on time.”

In the 60 Decibels Employers Insights Report, employers observed that EWA enhances employee well-being, modestly boosts productivity and retention, and significantly reduces financial worries and absenteeism.

- 9 out of 10 Employers believe that EWA streamlines payroll, boosts employee wellbeing, and reduces administrative stress for employers.

- 6 in 10 employers reported that the amount of time their employees spend worrying about finances had “very much decreased”.

- Nearly all found Paymenow’s rollout beneficial, and 9 in 10 employers “strongly agree” that EWA streamlines payroll administration.

- Nearly all employers “strongly agree” that Paymenow ensures the security of employees’ financial data and is user friendly.

- 8 out of 10 Employers would be “very disappointed” to lose access to Paymenow’s services.

Employers surveyed were in the fashion and retail, management and facilities, financial services, call-center services, manufacturing, hospitality and logistics industries. Respondents worked in payroll and benefits management, finance and accounting, and HR, and had been using Paymenow’s services for an average of 31 months.

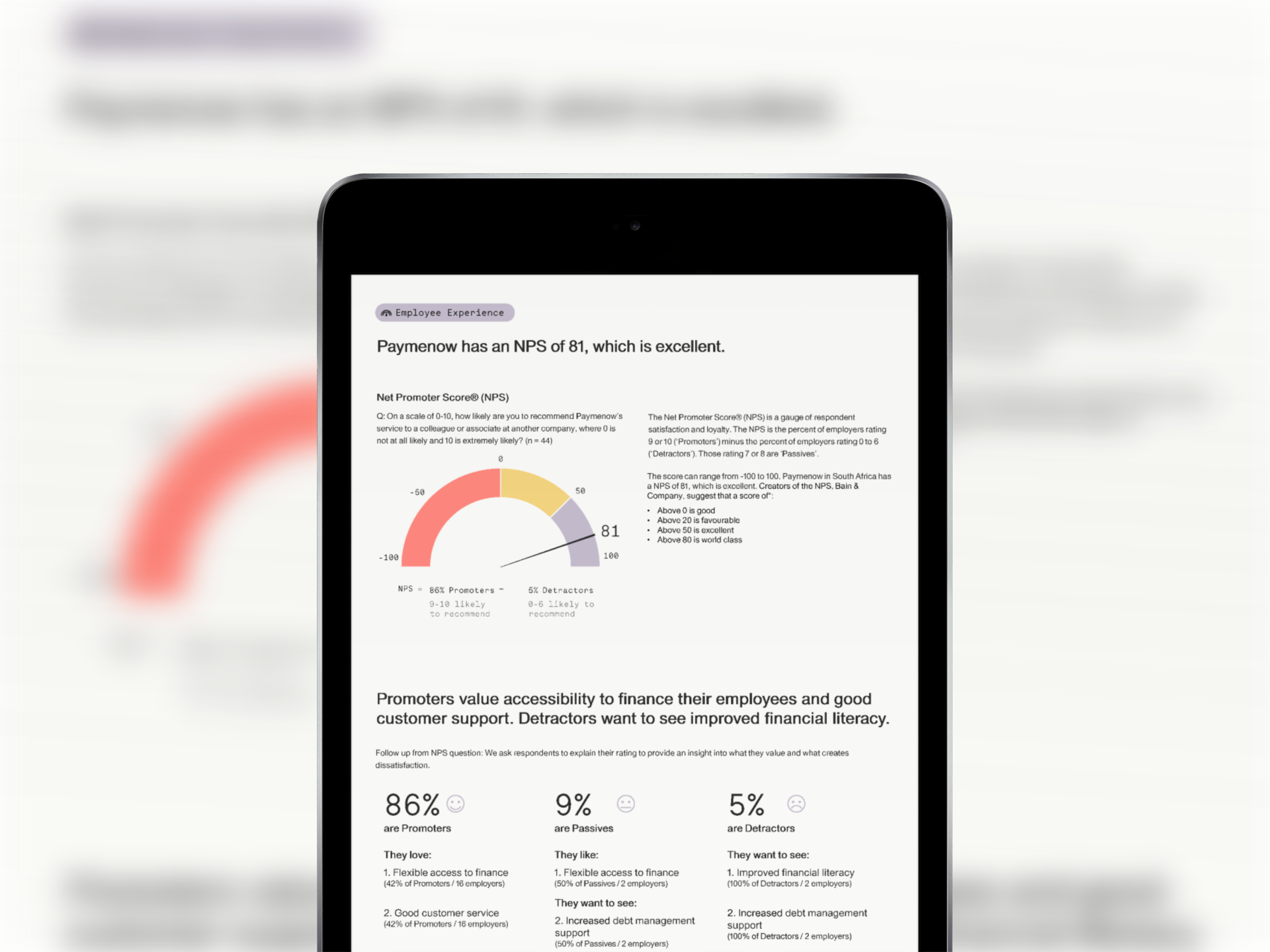

Paymenow has an NPS of 81 amongst employers, and 100% of employers were “very satisfied” with their technical support. Nobrega says that it was positive to see that employers valued Paymenow’s ease of use, data security, and effective communication. One employer reported that “Paymenow is a great service for our staff. The fees are very low, the service frees your employees from financial burdens, and they don’t have to borrow from loan sharks.”

“As organisations continue to prioritise employee wellbeing and seek competitive advantages in talent retention, EWA is emerging as an essential component of modern compensation packages, offering a sustainable alternative to traditional credit while fostering a more engaged and financially secure workforce,” concludes Nobrega.